We’ve written before about the importance of risk tolerance in investing and how we use technology in our commitment to excellent client satisfaction. In fact, our mission and values as a financial advisory practice include our ability to take initiative with new technologies and procedures. In working with clients to build their portfolio and manage their investments, those ideas come together in the risk analysis software that we use. In moving beyond addressing risk as simply aggressive or conservative, we incorporate technology to uncover the level of risk and type of investing best suited to your comfort level with risk and your overall financial goals. While all investing involves risk, how much you seek or can tolerate is unique to each client.

Assessing Risk Tolerance in A New Way

The classic model for risk tolerance says that younger investors should be aggressive while older investors should be conservative. That’s not necessarily the way that reality works, or that each investor sees their money.

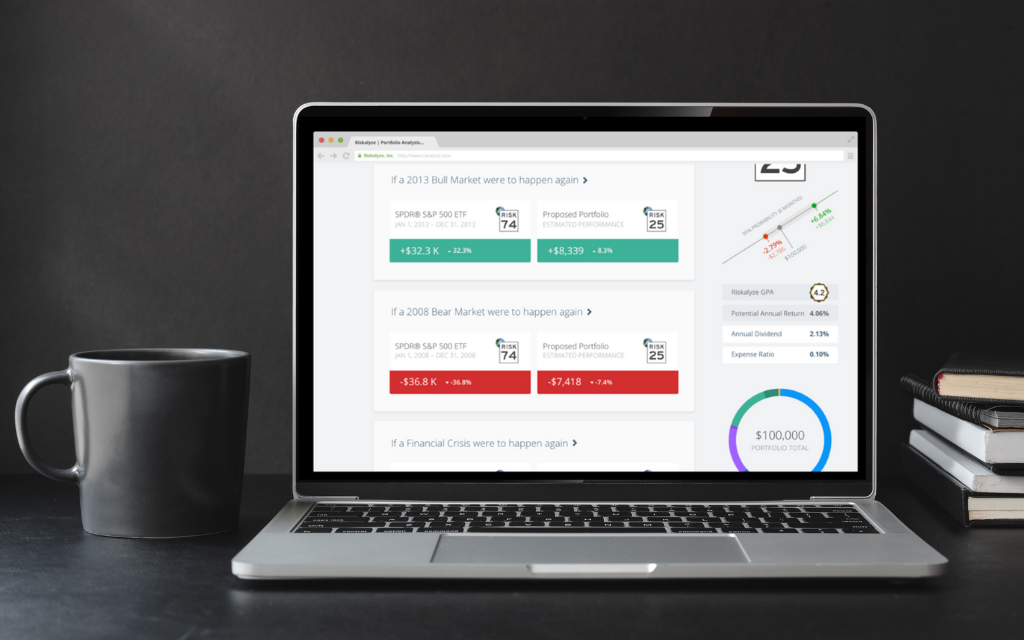

Part of our assessment of your risk tolerance uses a risk number. This approach develops a number from 1 to 99, where 1 is the least aggressive and 99 is the most aggressive. Your number pinpoints not only how much risk you want, but how much risk is in your portfolio and how much you need to reach your goals. To arrive at your risk number, our advisors can take you through a series of mathematical assessments based on your portfolio value to determine what you might be willing to trade in downside risk for potential upside gain. We also have discussions with you about your investments, risks, and goals.

Riskalyze Client-Facing Video from Riskalyze on Vimeo.

How We Apply the Risk Number To Your Investments

Risk tolerance may change over time. As you get older, you may choose to be more conservative. If you are saving for a specific short-term goal, you might also want to be more conservative. In our analysis, we compare your risk number to the current amount of risk in your investments and your goals for those investments. Using this comparison, strategic portfolio changes are made to align the investments with your comfort level with risk.

In our planning process, we can stress test your portfolio, model different scenarios, and set expectations for the future. Ultimately, we find where your goals, risk tolerance, and investments align in hopes of bringing you a better understanding of how they all build your financial future.

Our advisors regularly meet with clients to review your investments and risk tolerance. If you have any questions, don’t hesitate to reach out to us.

Marshall Financial Group is a SEC registered investment adviser. Information presented is for educational purposes only and for a broad audience. The information does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and are not guaranteed. Marshall Financial Group has reasonable belief that this marketing does not include any false or material misleading statements or omissions of facts regarding services, investment or client experience. Marshall Financial Group has reasonable belief that the content as a whole will not cause an untrue or misleading implication regarding the adviser’s services, investments or client experiences. Please refer to https://adviserinfo.sec.gov/ for Marshall Financial Group’s ADV Part 2A for material risks disclosures. Past performance of specific investment advice should not be relied upon without knowledge of certain circumstances of market events, nature and timing of the investments and relevant constraints of the investment. Marshall Financial Group has presented information in a fair and balanced manner.